To fund his large-scale infrastructure initiative, President Biden is planning to increase taxes. While these plans are still subject to significant change, it is time to start learning about the proposed changes to see if you could be affected. Forewarned is forearmed.

Today’s tax rates are among the lowest U.S. citizens have experienced since the inception of the federal tax code in 1913. Unfortunately, good times can’t last forever.

Corporate tax increases are on the front burner. Under the Biden tax plan, the corporate tax rate could increase from 21% to 28% and there could be an increase in taxation of international corporate income earned by U.S.-based companies. The proposal would increase the minimum tax on global profits of U.S. corporations to 21%. These increases could take effect as early as January 2022.

As for individual taxes, Biden would seek to reverse some of the 2017 Tax Cuts & Jobs Act changes. Below are 10 major tax changes that could come to fruition soon under the Biden administration and some ways that you can plan for the changes.

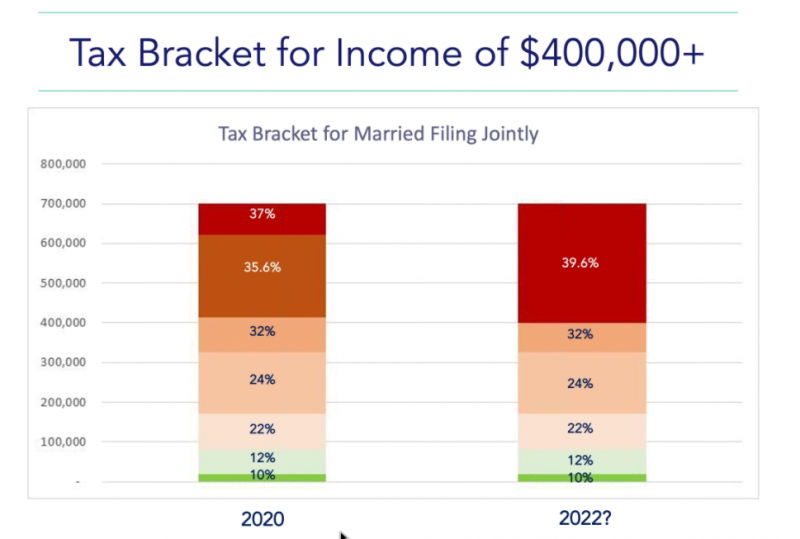

- Increase the top ordinary income tax rate for income over $400,000 to 39.6%.

It is unclear whether this is for families or individuals. It is currently 37% as enacted by the Tax Cuts and Jobs Act. Consider all strategies to bring down income, including funding traditional retirement plans, opening profit sharing/defined benefit plans, bunching deductions and so on. Consider charitable giving to decrease taxes.

“Right Capital”

“Right Capital” - Eliminate step-up in basis at death and potentially create a taxable event at that time.

This may be the most challenging provision to pass. If this change passes, it may be wise to consider “basis management” as an ongoing strategy to bring down gains in portfolios, particularly if the step-up in basis is done away with. Our advisors have some numerous strategies to help manage basis if this is enacted. - Replace deductions for contributions to IRAs, 401(k)s, and similar retirement accounts with a flat 26% credit.

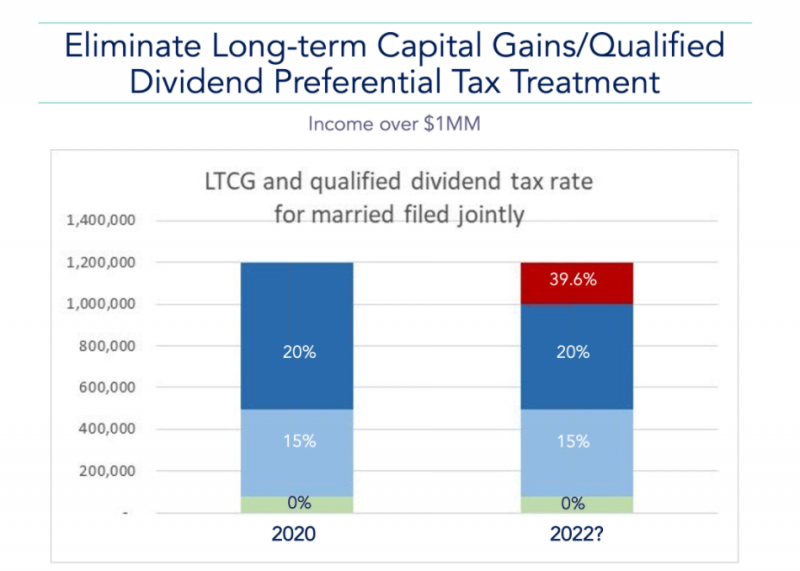

This would make Roth accounts more attractive for those with a high-net-worth as those would not be receiving their full deduction for their retirement account contributions. It would also make funding retirement accounts more attractive for lower-income investors. - Increase long-term capital gains rates on income $1,000,000 + from 20% to 39.6%.

Don’t forget the Medicare Tax of 3.8% on top of those amounts, regardless if the tax increase goes through or not. If passed, those with high incomes should plan to reduce the size of annual capital gains realized. That may mean accelerating gains into this year, gifting highly appreciated stock to charity, more attention paid to tax-loss harvesting, and deathbed planning (depending on whether the step-up in basis is still available). There are additional ways to lower income to avoid being in the highest bracket that our planners can discuss with you.

“Right Capital” - Unified gift and estate tax exemption amounts would decrease from $11.58M to $3.5M for individuals and $23.16M to $7M for married couples.

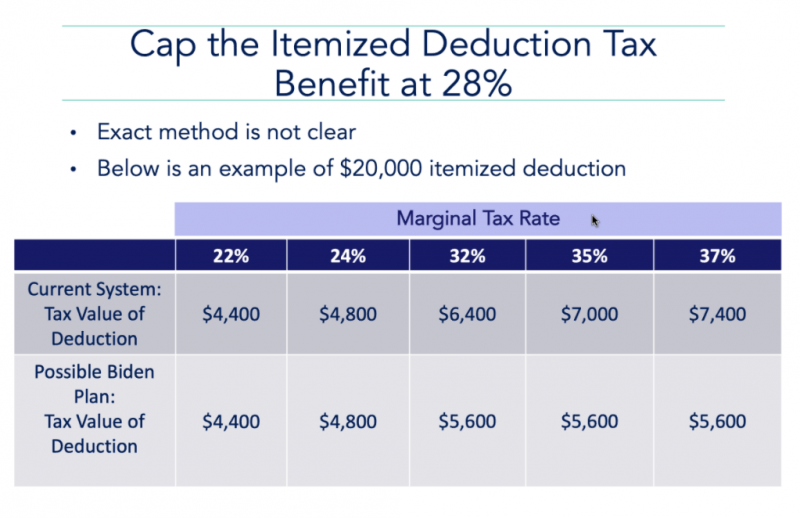

If your client falls in this category, please reach out to one of our advisors to discuss a course of action and plan to minimize estate taxes. - The maximum amount of itemized deductions would be no more than 28% for those earning over $400,000 (again unclear whether that is individual or joint).

“Right Capital” - The earned income tax credit would be expanded to include workers age 65 and older, without children living at home, who are considered “childless” for tax purposes.

- The Child and Dependent Care Tax Credit would increase from $3,000 to $8,000 for one child and from $6,000 to $16,000 for two or more children.

The maximum reimbursement rate would increase from 35% to 50%. The Child Tax Credit would increase from $2,000 to $3,000 per child ($3,600 for children 5 years old and younger). As it stands right now, these changes only apply to the 2021 tax year, but there could be an effort to extend the enhancements beyond this year. - The first-time home buyer credit would be restored with a maximum of $15,000.

Under the current rules, there is no first-time home buyer credit. - Tax-deferred 1031 exchanges for real estate would no longer be available.

Performing like kind exchanges this year in order to defer the gains may be a good plan, but make sure that any transaction qualifies under any tax law changes.

Some or all of these provisions may never pass, but we want you to be aware of the potential changes that may be relevant to your tax situation. In the meantime, we will be watching for any changes that do pass and will be sharing the updates with you as we have them. While there may be changes on the horizon, our advisors have plans to help you navigate them.